At Baynes Financial, we believe that true financial security is about more than just tracking numbers on a balance sheet or managing an investment account. It’s about having a comprehensive plan that provides peace of mind and confidence in your future, knowing that your finances are in order. That’s why we offer a holistic financial planning approach that covers every key aspect of your financial life—income, investments, taxes, healthcare, and your legacy. Here’s why this approach is so beneficial for the clients we work with.

Key Takeaways:

Financial Security: Comprehensive financial planning covers more than just investments; it ensures every aspect of your financial life, from income to taxes, healthcare, and estate planning, is aligned to secure your future.

Personalized Approach: Baynes Financial takes a personalized 5-step approach, starting with an in-depth assessment of your current status and goals, and continuing with ongoing adjustments to ensure your plan evolves with your life.

Peace of Mind Through Proactive Planning: Our clients enjoy peace of mind knowing their financial plan addresses potential risks such as running out of money, unexpected healthcare costs, or tax burdens in retirement.

What Is Comprehensive Financial Planning?

Comprehensive financial planning is not simply about picking the right stocks or opening a savings account. It’s about taking a 360-degree view of your financial situation and creating a roadmap that addresses every aspect of your financial life. At Baynes Financial, we break down this approach into five key components:

- Income Planning – Ensuring you have enough income to maintain your desired lifestyle throughout retirement.

- Investment Planning – Growing your assets to meet your long-term goals while managing risk.

- Tax Planning – Strategizing to minimize the taxes you pay now and in the future, especially in retirement.

- Healthcare Planning – Preparing for future medical expenses, including long-term care.

- Estate Planning – Ensuring your wealth is efficiently transferred according to your wishes when the time comes.

By addressing all these areas, we make sure no part of your financial life is overlooked, giving you the confidence to enjoy your retirement years without worry.

Comprehensive financial planning is about more than investments—it's a 360-degree approach to securing your future.

The Baynes Financial Approach to Comprehensive Planning

We understand that every client’s financial situation is unique. That’s why our comprehensive financial planning process is highly personalized, designed to meet each individual’s specific needs, goals, and circumstances. Here’s an overview of our 5-step approach, which includes continuous financial reviews:

Step 1: Assess Your Current Financial Status

The first step is understanding where you stand today. We take a deep dive into your income, expenses, assets, liabilities, and current investments. This thorough analysis gives us a holistic view of your financial picture, allowing us to create a tailored path forward. We call this our Financial Blueprint.

Step 2: Define Your Goals

Your financial goals are as unique as you are. Whether you want to retire early, fund your children's education, or leave a lasting legacy, we work closely with you to identify and prioritize your objectives.

Step 3: Build a Customized Plan

Once we understand your goals, we develop a personalized plan that integrates income planning, investment strategies, tax efficiency, healthcare needs, and estate planning. This ensures all aspects of your financial life are working in harmony to support your goals.

Step 4: Implement the Plan

With your custom financial plan in place, we guide you step by step through implementation. We ensure every action you take aligns with your financial priorities, helping you make informed decisions that move you closer to your goals.

Step 5: Ongoing Adjustments and Monitoring

Financial planning is not a one-time event. Life changes, and so do your financial needs. That’s why we regularly review and adjust your plan, ensuring it evolves with you and continues to guide you toward long-term success.

- Investment Review & Scenario Planning

- Retirement Account Contributions & Strategy

- Tax Return & Roth Analysis

- Personal Insurance Review (Odd Years)

- Estate Planning Update (Even Years)

Review Regularly: Life changes, and so should your financial plan. Schedule regular reviews with your financial advisor to ensure your plan stays aligned with your evolving needs.

This process is not just about planning—it’s about forming a lasting partnership where we continuously work together to keep your finances on track.

The Benefits of Comprehensive Financial Planning with Baynes Financial

Our clients often share how much more confident they feel after going through our comprehensive financial planning process. Here are some of the biggest benefits they experience:

1. Financial Peace of Mind

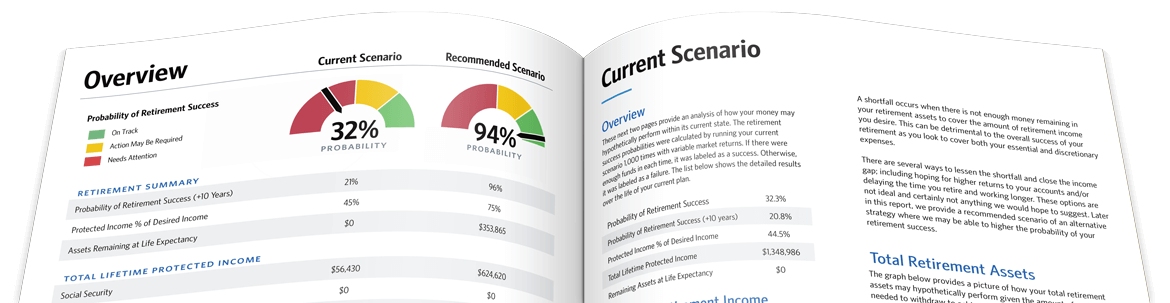

Knowing that every aspect of your financial life is accounted for brings peace of mind. A comprehensive plan addresses potential risks, like running out of money in retirement, unexpected healthcare costs, or future tax liabilities. With a plan in place, you can focus on living your life without worrying about what lies ahead.

2. Proactive Tax Strategy

Taxes can have a significant impact on your retirement savings if not managed properly. Without strategic planning, taxes can erode a large portion of your income. Our tax strategies are designed to help you keep more of what you’ve earned by minimizing tax liabilities now and in retirement. We ensure that your tax strategy works in harmony with the rest of your financial plan.

3. Maximizing Retirement Income

Retirement is a time to enjoy life, not worry about running out of money. We help maximize your guaranteed lifetime income by balancing different income sources, such as Social Security, pensions, and retirement accounts. Our investment strategies focus on preserving capital while providing growth, ensuring that your income needs are met.

4. Planning for Healthcare Needs

Healthcare can be one of the biggest expenses in retirement, but it doesn’t have to be a financial burden. We integrate healthcare planning into your overall financial plan, helping you prepare for potential costs, including Medicare and long-term care expenses.

5. Leaving a Legacy

Our comprehensive planning includes Enhanced Planning, making sure your wealth is passed down according to your wishes. Whether your goal is to provide for your family, support a charitable cause, or ensure your affairs are in order, we help make sure everything is handled smoothly and efficiently. We help you determine the potential taxes on your estate and give you guidance on how to reduce them.

Start Early for Better Results: The earlier you begin comprehensive financial planning, the more time you have to maximize your retirement income, minimize taxes, and prepare for healthcare expenses.

Real-Life Impact: A Case Study

To illustrate the power of comprehensive planning, let’s look at an example (names and details changed for privacy). John and Susan were approaching retirement with concerns about running out of money, potential medical costs, and the tax implications of withdrawing from their retirement accounts. After working with us, they received a comprehensive plan that:

- Showed them how to convert their retirement savings into steady, predictable income.

- Identified strategies to reduce their tax burden through strategic withdrawals.

- Included a long-term care insurance plan to protect them from unforeseen medical expenses.

- Created an estate plan to ensure their assets would smoothly transfer to their children.

With their new plan in place, John and Susan now have confidence in their retirement years, knowing that all potential risks are accounted for and managed.

Why Choose Baynes Financial?

At Baynes Financial, we are dedicated to helping our clients achieve their financial goals by providing personalized, comprehensive financial plans. We take the time to understand your unique situation and design a holistic plan that works for you. With our ongoing support, you can enjoy peace of mind, knowing that every aspect of your financial future is in expert hands.

Ready to take control of your financial future?

Step #1: Schedule Your 20-Min Phone Call

NOTE: It's not uncommon for our calendar below to have limited availability. We intentionally limit the number of calls to ensure we provide a high level of service to current clients. If you don't see anything on our calendar that works for you, please call our office at (909) 330-1400, and we will do our best to accommodate.