How Would You Rate Your Retirement Plan?

Get your Retirement Income Health Score with our complimentary analysis and see if you're on track or end up with an income shortfall.

Are You Worried About Not Having Enough Money in Retirement?

A Quick and Easy Way to Assess Your Current Plan

REQUEST YOUR ANALYSIS

Fill in your information and complete the form to express your interest

MEET WITH US

We'll schedule a time to meet and review your retirement goals

REVIEW YOUR SCORE

Access your report and view current and recommended scenarios

Why You Need an Analysis Report

Imagine how your outlook would change if you were able to FORECAST how your retirement would play out and, if necessary, be given outlined steps to enhance your probability for success. Would you feel less stressed? Would you have more hope? Would you be more confident and optimistic about your retirement?

Quincy Baynes, The Retirement Income Specialist, has created an analysis report that can do just that. We call it the Retirement Income Health Score Analysis and it's the most efficient, effective, and inexpensive way for you to know the probability rate of whether your retirement is going to be a success - or failure.

People planning for retirement are slowly realizing that they may end up with an income shortfall. This is where the amount of income you desire outpaces the amount of money you have saved.

And why is that? It's because we've been conditioned by Wall Street and the big banking companies to focus on growing our assets as much as possible and strive to obtain the highest rate of return.

Unfortunately, this advice never takes into account how these assets will be turned into income and has also left many of us exposed to the four key retirement risks: (1) longevity, (2) stock market, (3) income taxes, and (4) inflation.

We believe the only way to ensure a successful retirement is through an income plan that protects your money from the four key risks.

And The Retirement Income Health Score Analysis is the first step in creating that retirement income plan.

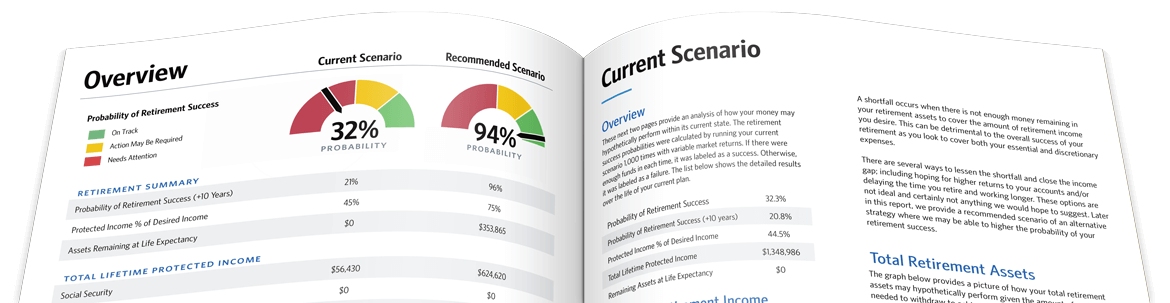

This report analyzes your current retirement plan and generates a Retirement Income Health Score based off of the probability for success. And if the report deems your current scenario as unsustainable, it'll show you ways to enhance your score by offering advanced product and strategy recommendations.

Our clients have peace of mind as they head into retirement because they finally have a plan with predictability and protection at its core.

Request your complimentary analysis report today!

What's Included in the Analysis?

Your The Retirement Income Health Score Analysis provides a rating from 1%-100% scoring your probability of success in retirement. Savings accounts are forecasted to show how they'll work together to provide you with income and recommendations are made to enhance your success score.

Here's What You Get in the Report:

Step #1: Schedule Your 20-Min Phone Call

NOTE: It's not uncommon for our calendar below to have limited availability. We intentionally limit the number of calls to ensure we provide a high level of service to current clients. If you don't see anything on our calendar that works for you, please call our office at (909) 330-1400, and we will do our best to accommodate.

Frequently Asked Questions

Nothing! This is a complimentary analysis of your current retirement income plan. It's a complimentary service we provide to all prospective clients.

The report includes information on your Social Security benefits and other savings accounts.

We'll need to collect the latest statements and documents for the report to be as accurate as possible.

Not a problem! This is merely a second opinion on your retirement income plan.

Keep in mind, product and strategy recommendations will be made within the report, but you'll have the freedom to decide what you'd like to do next.

You should consider hiring our firm if you want to:

- Turn your nest egg into a reliable paycheck in retirement.

- Lower taxes and keep more of your hard-earned money.

- Improve after-inflation returns and reduce portfolio risk.

- Spend more of your time doing the things you love in retirement.

- Ensure your heirs have a trusted professional to lean on if something happens to you.

You can learn more about our expertise by reading our blog.

We are working with clients in the state of California but if you are interested in working with us fill out the form and above and let's have a conversation.

Our firm regularly meets with clients through Zoom video conferencing. Each virtual meeting is protected by a complex, unique password, and we adhere to strict security guidelines to protect your privacy.

It only makes sense to hire a financial advisor—or any professional—if the value they provide exceeds the cost.

In other words, the time and effort saved by hiring an expert + the tax savings and retirement plan improvements need to exceed the fees being charged.

The Free Retirement Assessment we deliver will quantify the benefits you will receive so you can make an informed decision about hiring our firm.

Our transparent fee includes ongoing retirement and tax planning + tax-smart management of all investment accounts.

The blended fee is calculated based on a percentage of the total value of the investments we oversee and manage:

(Depending on the client's situation and scope of work, a flat annual fee may be considered instead of a % based fee.)

Scheduling your first phone call with us is the first step in determining whether we are a good fit to work together.

Not at all! This is simply a snapshot of the current state of your plan. Accounts and other factors are not affected.

The first thing you need to do is request the complimentary analysis by filling out the form on this page.

Once that's submitted, our team will reach out to you to confirm the appointment.

We'll meet with you either virtually or one-on-one and discuss your retirement goals. We'll also collect the necessary information at that time.

After that, the report will be generated and we'll schedule a follow-up to present to you your custom report.

The timeline depends on your availability, but the overall analysis review typically takes between 1-2 weeks.

There are three really important things about our firm that separate us from others:

- We are retirement and tax planning experts for people aged 45+. Just like a Cardiologist would not perform foot surgery, we remain highly specialized and only work with retirement savers we have the expertise to help.

- We limit the number of new clients we take on. This allows us to provide unparalleled value and highly personalized service to the families that have entrusted our firm to help them.

- We work as a team to service our clients. Instead of being "assigned" to a financial advisor, clients work with our entire team. Combining our resources and intellectual capital enables us to deliver high-quality advice and ensure nothing falls through the cracks.

Most advisors have similar titles, designations, and service models. Many of us also work with similar vendors and custodians.

The fact that it's hard to differentiate one advisor from another is EXACTLY why we offer a Free Retirement Assessment.

If you think there is a potential fit between your needs and our expertise, the first step is to schedule a complimentary phone call.

One key component of our mission is to provide a world-class client experience. To help accomplish this, we work closely with high-quality custodians who allow us to do our best work for you.

Altruist is a modern custodian that provides the latest in financial technology. Their platform helps us work more efficiently and reduce costs, enabling us to provide you with the best service possible.

If you think there is a potential fit between your needs and our expertise, the first step is to schedule a complimentary phone call.

Yes.

Your CPA is excellent for accounting for what happened last year. Often, they don’t work on limiting your tax liability in the future.

At Baynes Financial, we help you look at the big picture and offer strategies to optimize your spending and saving for tax efficiencies. You (or your CPA) will still be responsible for filing your return.

If you think there is a potential fit between your needs and our expertise, the first step is to schedule a complimentary phone call.